How much Russians love pizza: Dodo’s study of the Russian pizza market

29 November 2017

Okay, we’ve been in the pizza business for almost seven years. And recently, we asked ourselves: in general, how popular is pizza in Russia—our home country, where Dodo Pizza is the market leader?

With more than 230 deliveries, we now have the biggest pizza chain in Russia. Today, the Dodo brand is present in the capital, as much as in Russia’s regional centers and small towns from Kaliningrad, the country’s western outposts, to the Far East. If anyone has the data to answer this question, it’s us.

So our team crunched some numbers, and it turned out that…

In this study, we focused on our delivery customers because we can easily identify them.

When you show up at our pizzeria and make an order, we don’t know if you’re visiting us for the first time in your life or if it's your third visit just this week (unless you are a member of our loyalty program).

While ordering for delivery, our customers must provide their mobile number. So we know who is who. Some people may place orders using different phones. Still, the data we get are pretty reliable, though you can expect real numbers to be a bit more optimistic.

I’d say that the country where even pizza fans tend to have around 2–3 pizzas a month promises huge opportunities for growth. About 1 in 8 Americans eat pizza on any given day.

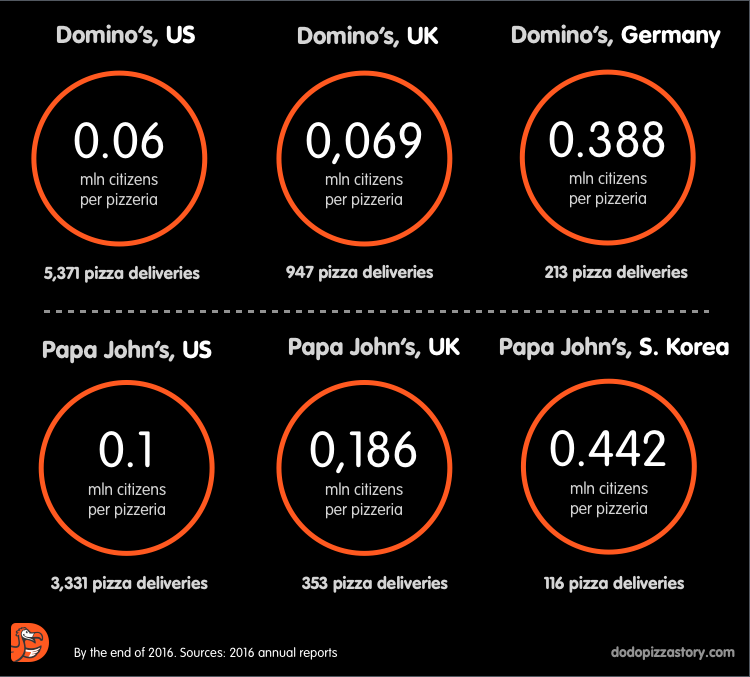

Just out of curiosity, we calculated how many citizens there are in Russia per one pizzeria for the three leading delivery chains: Dodo Pizza, Papa John's, and Domino's.

Obviously, having more than 1 million citizens per pizza shop is quite a lot—more than enough opportunities to grow for our competitors.

But how much growth is there for a pizza chain that, like Dodo Pizza, already has one pizzeria per 600 thousand citizens?

Let's use public data to calculate penetration for the leading global pizza chains for a few other countries. Of course, these numbers don't take into account the competition, which can be different in every country. But, hopefully, it will give us some insight about how big a chain it's possible to build.

These calculations are based on numbers provided by the two companies in their annual reports for 2016. Of course, in 2017, things changed. For example, Domino's became the market leader in Germany, having added around 170 pizza shops after it acquired Hallo Pizza.

So their current penetration in Germany should be around 242 thousand citizens per pizzeria. Still, even that is 2.5 times better than ours in Russia.

Dodo Pizza aims to open 1,500 pizza shops in our home country eventually. That will bring us close to the same "citizens per shop" rate as Papa John's has in the States.

What about the taste? Well, here are the six most popular pizzas at Dodo Pizza. They constitute 48.85% of all pizzas sold in Russia by our chain in a year.

Nothing unusual here, huh? Russians remain pretty conservative in their tastes. We used to offer a corn pizza. It sold only around 4,000 a year.

Up to this point, we've been talking about averages. What about the extremes? Take a look at these records that were registered by our internal informational system, Dodo IS.

$3,573 a year equals almost $300 a month! Of course, people who order that many pizzas don't devour them by themselves. They buy them for their families, friends, and colleagues.

Still, 847 bucks for one order… That was quite a party.

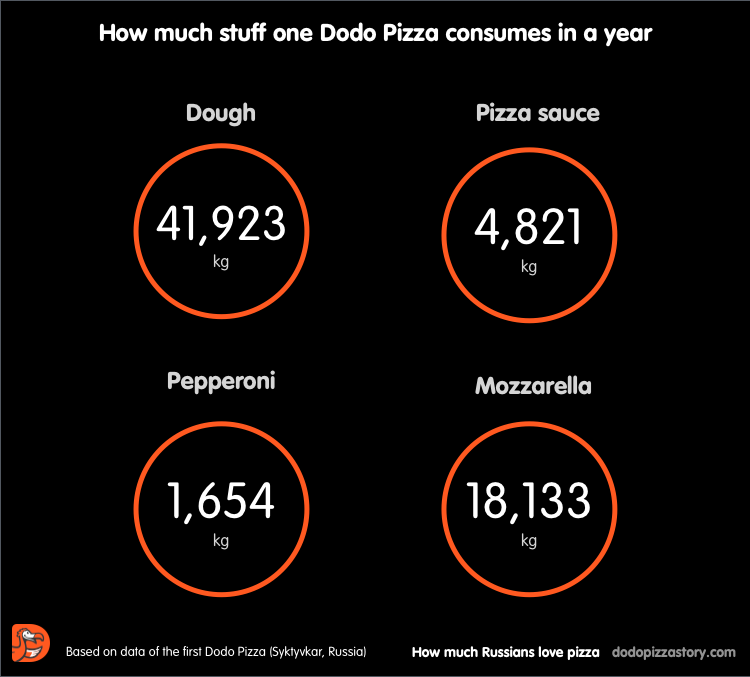

And just for kicks, here are some figures that show what it takes to keep one pizza shop up and running for a year—in terms of the most basic ingredients it consumes:

That's it for now. We've just started digging into masses of data that Dodo IS conceals. So expect more interesting reports and insights on this blog in the near future.